Best Finance android app for students in US

With uncountable expenses lurking around, using a financial app can be an essential for US students. There many choices for student-focused finance apps and they provide invaluable support. With the help of these apps, students can keep tabs on their expenses, make frugal savings, and manage their money even when they’re on the go. Students can efficiently manage their finances and reduce the stress that comes with money matters by using the right budgeting app. Let’s look at some of the top finance Android apps created especially with US students’ needs in mind.

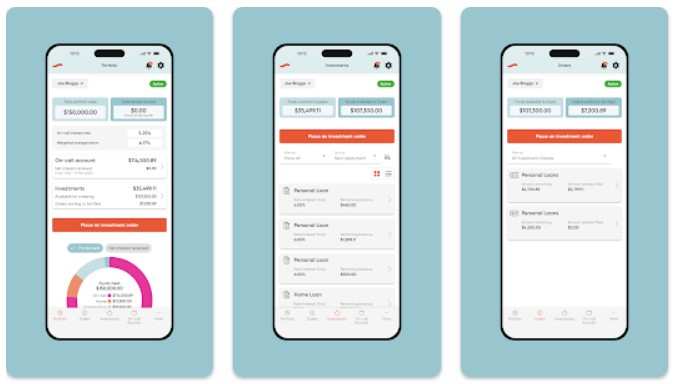

#1 Squirrel

More than just a budgeting tool, Squirrel is a financial guardian that enables users to easily manage their savings and spending. Squirrel is a financial management tool that is meant to reduce stress and anxiety by providing a full range of features that make budgeting, saving, and bill paying easier.

Squirrel essentially acts as a barrier between your source of income and your bank account, giving you a disciplined method of handling your finances. Through smart disbursement of money into your primary bank account only when required, Squirrel makes sure that every pound has a purpose and protects savings from the risk of careless spending.

Squirrel’s ability to customize your financial management according to your unique needs and goals is one of its best features. With Squirrel, you can set specific goals and allocate funds based on those goals—be they building a nest egg, saving for a vacation, or preparing for Christmas. As you move closer to your financial goals, this tailored approach not only promotes discipline but also a sense of accomplishment.

Additionally, Squirrel makes budgeting easier by dividing your monthly pay into weekly allowances that are doable. This methodical approach guarantees that you won’t be taken by surprise expenses and encourages responsible spending habits.

Customizing your financial management with Squirrel to meet your unique needs and objectives is one of its best features. Squirrel enables you to set specific goals and allocate funds in accordance with them, whether your goal is to save for a vacation, prepare for Christmas, or simply accumulate savings. This individualized approach helps you reach your financial goals while promoting discipline and a sense of accomplishment.

Additionally, by dividing your monthly salary into manageable weekly allowances, Squirrel makes budgeting easier. By taking a methodical approach, you can avoid being caught off guard by unforeseen expenses and encourage responsible spending habits.

The interface is easy to grasp even for a 12-year-old and with that much exaggeration, it is obvious that everything else will be also easy to understand. From the tracking of expenses, and how you have built up your spending to adjusting budgets, everything is simple with this app. Additionally, Squirrel offers comfort in knowing that your financial data is safeguarded and supervised by the Financial Conduct Authority (FCA) due to its emphasis on security and regulatory compliance.

Squirrel provides a risk-free trial period for those who are hesitant to commit, enabling users to personally experience the benefits prior to making a decision. After the trial period, Squirrel offers great value for its extensive feature set and unmatched peace of mind, with a low monthly subscription fee of £3.99.

#2 Goodbudget

The budgeting tool Goodbudget manages finances with a special envelope mechanism. It’s an excellent choice for college students as it encourages frugal spending and keeps them in control of their money. This app has visual budgeting that shows categories including rent, grocery, and entertainment. You can see it as virtual assistant of yours who gives you compelling informative visuals. Budgeting is tangible and simple to comprehend with this visual aid, especially for people who are not experienced with money management. With Goodbudget, students can keep tabs on how much they spend on each envelope. This enables them to spot potential areas of overspending and make the necessary adjustments to their budget.

Roommates can use Goodbudget to track joint expenses, manage a budget, and make sure each person pays their fair part of rent, utilities, and other shared costs. Most college students may get by with the features of Goodbudget’s free edition. It enables the creation of several envelopes, tracking of earnings and outlays, and report generation. Goodbudget’s visual envelope concept is simple to use, in contrast to intricate spreadsheets or other budgeting techniques. Without being overwhelmed, college students may set up and manage their finances with ease.

Overall, college students may easily manage their funds using Goodbudget thanks to its visual approach and simplicity. With Goodbudget, you can designate distinct envelopes for financial purposes such as college textbooks or a spring break vacation. Students are encouraged to track and record their progress toward their goals by seeing this visual reminder.

#3 Acorn

Acorn is a ground-breaking app that dispels the myth that investing needs large sums of money. With Acorns, you can turn even spare change into a healthy investment portfolio. As a student, this app gives you a perfect opportunity to invest in your future monetarily. Most students do not have hundreds of thousands of dollars in their savings account that is why Acorn is a good choice. It enables users to easily invest while going about their daily routines by integrating with your regular purchases.

The app’s basic yet clever idea is to round up all of your daily transactions to the closest dollar and invest the difference. For example, if you pay $4.30 for a coffee, Acorns will invest the remaining 70 cents and round up the amount to $5.00. With the help of this cutting-edge feature, users can invest passively and without even realizing how it affects their daily spending.

Users only need to link their credit card to the app and use it for purchases in order to activate the roundup feature. This guarantees that every transaction, regardless of size, adds to their investment portfolio. Furthermore, Acorns gives users the option to deposit funds straight into the app, allowing them to begin investing with as little as $5.

Acorns’ usability and accessibility are what make it so beautiful. Acorns easily fits into your routine, transforming ordinary transactions into chances to build wealth, whether you’re getting a quick snack or satisfying your morning caffeine fix. Additionally, Acorns offers a selection of preconfigured investment portfolios that are customized for each user based on their risk tolerance and financial objectives. Users can alter their investment strategy to suit their own needs, ranging from aggressive to conservative portfolios.

Acorns makes investing accessible to people of all income levels by democratizing it with its user-friendly interface and low entry barriers. Acorns gives users the ability to take charge of their financial future and start building wealth one transaction at a time by utilizing spare change.

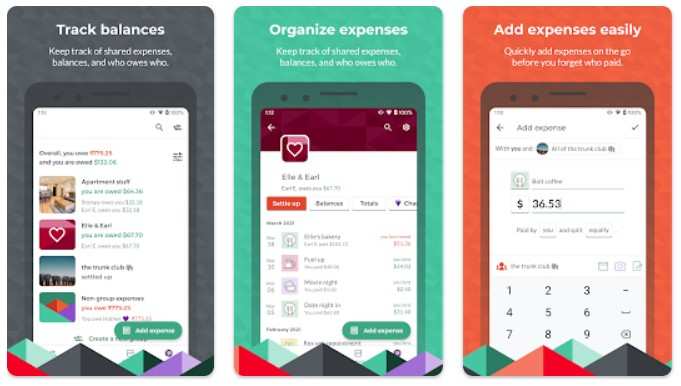

#4 Splitwise

Splitwise is a revolutionary bill-splitting tool that makes it easier to keep track of shared expenses and debts. Splitwise makes it easier to manage IOUs and shared expenses, whether you’re planning a group vacation or splitting the cost of a meal with friends.

Splitwise makes it simple for users to enter the total cost of a bill and identify the people who are responsible for it. Users can simply track who owes what and settle debts accordingly thanks to this user-friendly interface, which makes sure that everyone is on the same page at all times. Splitwise makes going Dutch easy by taking care of the bother of following up with people to collect payments, whether you’re ordering pizzas for a movie marathon or organizing a day trip with your roommates.

Numerous features are available in the app to improve user experience, such as the ability to split expenses equally or unequally by different methods, calculate group totals, and categorize expenses. In order to increase flexibility, users can also add multiple payers to a single expense, establish recurring bills, and add informal debts and IOUs.

Splitwise also offers a number of other features, including activity feeds, personalized user avatars, group cover photos, and push alerts to notify users of updates. Splitwise is the best tool for tracking debts and streamlining shared expenses because it offers excellent customer support and makes it simple to restore deleted groups or bills.

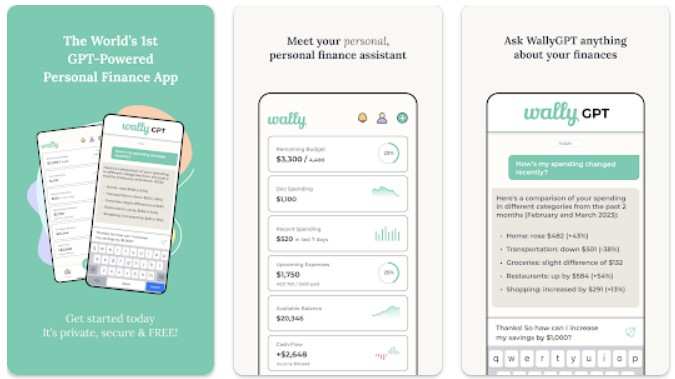

#5 Wally

Have you ever thought that AI will also be powering your finance app? Well, Wally has some AI tricks that gives feature-rich and personalized financial management tools. Wally provides users with a consolidated view of their financial life through its user-friendly interface and robust features, doing away with the need for guesswork and manual tracking.

Wally’s unique feature is its automatic tracking and categorization of all spending, which gives users instantaneous financial habit insights. Users can effortlessly connect all of their accounts, track balances and net worth across multiple currencies, and take advantage of over 15,000 banks’ support.

Sophisticated bill management are also present in Wally in addition to basic expense tracking. In order to help users stay on top of their finances and prevent late fees, users can conveniently view upcoming bills and payments and receive notifications before they are due.

Wally’s intelligent tools make budgeting and managing them simple. Users can track progress across spending categories while on the go and alter budget types, durations, and other features to suit their unique needs.

Furthermore, users can customize Wally to suit their own tastes thanks to its customization features. Wally’s customizable rules can be used to rename companies for spending records, set up repeat rules, or reclassify transactions to suit the needs of specific users.

Conclusion

Personal finance is already a significant activity that helps you grow with your finances. If you can manage your finances from your student stages, you will be set for life. Start with these finance apps that you find easily and create a healthy relationship with your money.